Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 18, 2017: The proxy statement and annual report to stockholders are available atwww.proxyvote.com.

April 6, 201723, 2019

DEAR STOCKHOLDER:DEAR STOCKHOLDER:

You are cordially invited to attend our 20172019 annual meeting of stockholders to be held at8:30 a.m., Eastern Time, on May 18, 2017,16, 2019, at our offices located at Three Limited Parkway, Columbus, Ohio 43230. Our Investor Relations telephone number is(614) 415-7585 should you require assistance in finding the location of the meeting. The formal Notice of Annual Meeting of Stockholders and proxy statement are attached. If you plan to attend, please bring the Admittance Slip located at the back of this booklet and a picture I.D., and review the attendance information provided. I hope that you will be able to attend and participate in the meeting, at which time I will have the opportunity to review the business and operations of our company.

The matters to be acted upon by our stockholders are discussed in the Notice of Annual Meeting of Stockholders. It is important that your shares be represented and voted at the meeting. Accordingly, after reading the attached proxy statement, would you kindly sign, date and return the enclosed proxy card or vote by telephone or via the Internet as described on the enclosed proxy card. Your vote is important regardless of the number of shares you own.

Sincerely yours, | |

|  |

Leslie H. Wexner | |

| |

Chairman of the Board |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 18, 201716, 2019

April 6, 201723, 2019

TOTO THE STOCKHOLDERS STOCKHOLDERS OF L BRANDS, INC.BRANDS, INC.:

We are pleased to invite you to attend our 20172019 annual meeting of stockholders to:

Elect the four nominees proposed by the Board of Directors as directors to serve for a three-year term.

Hold an advisory vote on the frequency of future advisory votes on named executive officer compensation.

Vote on the stockholder proposal to change certainremove supermajority voting requirements, if properly presented at the meeting.

Stockholders of record at the close of business on March 24, 201722, 2019 may vote at the meeting.If you plan to attend, please bring the Admittance Slip located at the back of this booklet and a picture I.D., and review the attendance information provided. Your vote is important. Stockholders of record can give proxies by calling a toll-free telephone number, by using the Internet or by mailing their signed proxy cards. Whether or not you plan to attend the meeting, please vote by telephone or via the Internet or sign, date and return the enclosed proxy card in the envelope provided. Instructions are included on your proxy card. You may change your vote by submitting a later dated proxy (including a proxy via telephone or the Internet) or by attending the meeting and voting in person.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 16, 2019: The proxy statement and annual report to stockholders are available at www.proxyvote.com. We encourage you to review all of the important information contained in the proxy materials before voting.

If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor:

Innisfree M&A Incorporated

501 Madison Avenue, 20th floor

New York, New York 10022

Shareholders may call toll free: (888) 750-5834

Banks and Brokers may call collect: (212) 750-5833

By Order of the Board of Directors, | |

| |

| Leslie H. Wexner |

| |

Chairman of the Board |

PROXY STATEMENT TABLE OF CONTENTS

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

The Board of Directors (the “Board”) is soliciting your proxy to vote at our 20172019 annual meeting of stockholders (or at any adjournment of the meeting). This proxy statement summarizes the information you need to know to vote at the meeting. In this proxy statement, “we,” “our,” “L Brands” and the “Company” refer to L Brands, Inc.

We began mailing a printed copy of this proxy statement and the enclosed proxy card or the Notice of Internet Availability of Proxy Materials (the “Notice”), on or about April 7, 201726, 2019 to all stockholders entitled to vote. The Company’s 20162018 Annual Report on Form10-K, which includes our financial statements, is being sent with this proxy statement and is also available in paper copy by request or in electronic form.

Date, Time and Place of Meeting

Date: | May |

Time: | 8:30 a.m., Eastern Time |

Place: | Three Limited Parkway, Columbus, Ohio 43230 |

Attending the Meeting

Stockholders who plan to attend the meeting in person must bring photo identification and the Admittance Slip located at the back of this booklet. Because of necessary security precautions, bags, purses and briefcases may be subject to inspection. To speed the admissions process, stockholders are encouraged to bring only essential items. Cameras, camcorders or videotaping equipment are not allowed.

Shares Entitled to Vote

Stockholders entitled to vote are those who owned Company common stock (which we refer to throughout this proxy statement as “Common Stock”) at the close of business on the record date, March 24, 2017.22, 2019. As of the record date, there were 284,809,090275,213,368 shares of Common Stock outstanding. Each share of Common Stock that you own entitles you to one vote.

Voting Your Shares

Whether or not you plan to attend the annual meeting, we urge you to vote. Stockholders of record can give proxies by calling a toll-free telephone number, by using the Internet or by mailing their signed proxy cards. The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give their voting instructions and to confirm that stockholders’ instructions have been recorded properly. If you are voting by mail, please complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you are voting by telephone or via the Internet, please use the telephone or Internet voting procedures set forth on the enclosed proxy card. Returning the proxy card or voting via telephone or the Internet will not affect your right to attend the meeting and vote.

The enclosed proxy card indicates the number of shares that you own.

Voting instructions are included on your proxy card. If you properly fill in your proxy card and send it to us or vote via telephone or the Internet in time to vote, one of the individuals named on your proxy card (your “proxy”) will vote your shares as you have directed. If you sign the proxy card or vote via telephone or the Internet but do not make specific choices, your proxy will follow the Board’s recommendations and vote your shares in the following manner:

| • | “FOR” the election of the Board’s four nominees for director (as described on page 4); |

| • | “FOR” the ratification of the appointment of our independent registered public accountants (as described on page 13); |

| • | “FOR” on the advisory vote to approve named executive officer compensation (as described on pages 14 and 15); and |

| • | “FOR” on the stockholder proposal (as described on page 16). |

1

“FOR” the election of the Board’s four nominees for director (as described on pages 5 and 6);

“FOR” the ratification of the appointment of our independent registered public accountants (as described on page 13);

“FOR” on the advisory vote to approve named executive officer compensation (as described on pages 14 and 15);

“1 Year” on the advisory vote on the frequency of future advisory votes on named executive officer compensation (as described on page 16); and

“AGAINST” the stockholder proposal (as described on pages 17 to 19).

If any other matter is properly presented at the meeting, your proxy will vote in accordance with his or her best judgment. At the time this proxy statement went to press, we knew of no other matters to be acted on at the meeting. See “—Vote Necessary to Approve Proposals” for a discussion of the votes required to approve these items.

Certain stockholders received a Notice containing instructions on how to access this proxy statement and our 2016 Annual Report on Form10-K via the Internet. Those stockholders should refer to the Notice for instructions on how to vote.

Revoking Your Proxy

You may revoke your proxy by:

submitting a later dated proxy (including a proxy via telephone or the Internet);

Voting in Person

If you plan to vote in person, a ballot will be available when you arrive. However, if your shares are held in the name of your broker, bank or other nominee, you must bring an account statement or letter from the nominee indicating that you were the beneficial owner of the shares at the close of business on March 24, 2017,22, 2019, the record date for voting, as well as a proxy, executed in your favor, from the nominee.

Appointing Your Own Proxy

If you want to give your proxy to someone other than the individuals named as proxies on the proxy card, you may cross out the names of those individuals and insert the name of the individual you are authorizing to vote. Either you or that authorized individual must present the proxy card at the meeting.

Quorum Requirement

A quorum of stockholders is necessary to hold a valid meeting. The presence in person or by proxy at the meeting of holders of shares representing at leastone-third of the votes of the Common Stock entitled to vote constitutes a quorum. Abstentions and “brokernon-votes” are counted as present for establishing a quorum. A brokernon-vote occurs on an item when a broker is not permitted to vote on that item absent instruction from the beneficial owner of the shares and no instruction is given.

Vote Necessary to Approve Proposals

Pursuant to the Company’s Bylaws, each director will be elected by a majority of the votes cast with respect to such director. A majority of the votes cast means that the number of votes “for” a director’s

election must exceed 50% of the votes cast with respect to that director’s election. Any “against” votes will count as a vote cast, but “abstentions” will not count as a vote cast with respect to that director’s election. Under Delaware law, if the director is not elected at the annual meeting, the director will continue to serve on the Board as a “holdover director.” As required by the Company’s Bylaws, each director has submitted an irrevocable letter of resignation as director that becomes effective if he or she does not receive a majority of votes cast in an election and the Board accepts the resignation. If a director is not elected, the Nominating & Governance Committee will consider the director’s resignation and recommend to the Board whether to accept or reject the resignation.

|

With respect to the advisory vote on the frequency of future advisory votes on named executive officer compensation, the voting option, if any, that receives the affirmative vote of a majority of the votes present in person or by proxy and voting thereon will be the option adopted by the stockholders. While this vote is required by law, it will neither be binding on the Company or the Board, nor will it create or imply any change in the fiduciary or other duties of, or impose any additional fiduciary or other duties on, the Company or the Board. However, the Compensation Committee and the Nominating & Governance Committee will take into account the outcome of the vote in making a determination on the frequency of future advisory votes on named executive officer compensation. If none of the three voting options receives a majority, the Board will consider the voting option that receives the plurality of votes cast.

The stockholder proposal requires the affirmative vote of a majority of the votes present in person or by proxy and voting thereon.

2

Impact of Abstentions and BrokerNon-Votes

You may “abstain” from voting for any nominee in the election of directors and on the other proposals. Abstentions with respect to the election of directors and on the other proposals will be excluded entirely from the vote and will have no effect.

In addition, under New York Stock Exchange (“NYSE”) rules, if your broker holds your shares in its name, your broker is permitted to vote your shares on the proposal to ratify Ernst & Young LLP as our independent registered public accountants, even if it did not receive voting instructions from you. Your broker may not vote your shares on any of the other matters without specific instruction. A “brokernon-vote” occurs when a broker submits a proxy but refrains from voting. Shares represented by brokernon-votes are counted as present or represented for purposes of determining the presence of a quorum but are not counted as otherwise present or represented.

Obtaining Additional Copies of the Proxy Materials

We have adopted a procedure called “householding.” Under this procedure, stockholders who share the same last name and reside at the same mailing address will receive one Notice or one set of proxy materials, (if they have elected to receive hard copies of the proxy materials), unless one of the stockholders at that address has notified us that they wish to receive individual copies. Stockholders who participate in householding continue to receive separate control numbers for voting. Householding does not in any way affect dividend check mailings.

If you hold Common Stock and currently are subject to householding, but prefer to receive separate copies of proxy materials and other stockholder communications from the Company, or if you are sharing an address with another stockholder and would like to consent to householding, you may revoke or grant your consent to householding as appropriate at any time by calling toll-free at1-866-540-7095 or notifying our Secretary at our principal executive offices at Three Limited Parkway, Columbus, Ohio 43230.

A number of brokerages and other institutional holders of record have implemented householding. If you hold your shares beneficially in street name, please contact your broker or other intermediary holder of record to request information about householding.

3

PROPOSAL 1: ELECTION OF DIRECTORS

The Board has nominated four directors for election at the annual meeting. If you elect the four nominees, they will hold office for a three-year term expiring at the 20202022 annual meeting or until their successors have been elected. All

The Board believes in the necessity of ongoing Board refreshment, and rigorous self-evaluation, diversity and succession planning. Over the past year, we have demonstrated this commitment. We listened to and engaged with our shareholders and other stakeholders on Board refreshment. We focused our efforts on recruiting strategies to identify new directors who embody the skills, experience, diversity and independence of perspective critical to oversee our Company’s strategies for delivering long-term shareholder value. Working with a search firm, the Nominating & Governance Committee recommended Sarah E. Nash and Anne Sheehan as potential director candidates to the Board, and the Board accepted such recommendation and nominated Ms. Nash and Ms. Sheehan to stand for election at the annual meeting. If all of our nominees are currently servingelected this year, we would have added five new directors since 2014, and five of our twelve directors will be women.

The Board has in place a robust process that will allow us to continue to refresh the Board and its leadership significantly over the next several years and beyond. We want a thoughtful approach to succession planning and an orderly transition, and the Board seeks to strike a balanced approach that allows the Board to benefit from the right mix of newer directors who bring fresh perspectives and seasoned directors who bring continuity and deep insight into our business and strategies. The Company believes that an effective Board consists of individuals who possess a variety of complementary skills, a range of tenures and a diversity of perspectives. We intend to refresh our Board and assess our Board succession plans with this in mind. The Nominating and Governance Committee and the Board consider the performance, contributions, skills and experience of our Board members in the broader context of the Board’s overall composition, with a view toward constituting a Board that has the integrity, judgment, skill set, experience and other characteristics to oversee the broad set of challenges that the Company faces and evaluate management on our Board.executing the Company’s business strategy.

We believe that our Board as a whole possesses the appropriate diversityright mix of experience, qualifications, skills and skillsexperience to oversee and address the key issues facing our Company. In addition, we believe that eachCompany now, and the commitment to Board refreshment to ensure this moving forward.

At the Company's 2020 annual meeting, the Board will submit a proposal to stockholders to amend our certificate of incorporation to declassify the Board. If such proposal is approved by our stockholders at the Company's 2020 annual meeting, all of our directors possesses key attributes that we seek in a director, including strong and effective decision-making, communication and leadership skills.will stand for election annually for one-year terms beginning at the Company's 2021 annual meeting.

Set forth below is additional information about the experience and qualifications of each of the nominees for director, as well as each of the current members of the Board, that led the Board to conclude, at the time each individual was nominated to serve on the Board, that he or she would provide valuable insight and guidance as a member of the Board.

Your proxy will vote for each of the nominees unless you specify otherwise. If any nominee is unable to serve, your proxy may vote for another nominee proposed by the Board. We do not know of any nominee of the Board who would be unable to serve as a director if elected.

The Board recommends a vote FOR the election of all of the following nominees of the Board:

If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor:

Innisfree M&A Incorporated

501 Madison Avenue, 20th floor

New York, New York 10022

Shareholders may call toll free: (888) 750-5834

Banks and Brokers may call collect: (212) 750-5833

4

Nominees of the Board at the 20172019 Annual Meeting

Patricia S. Bellinger | Director since 2017 | Age 58 |

Ms. Bellinger is the Chief of Staff and Strategic Advisor to the President of Harvard University, an institution of higher education. From 2017 to 2018, she was a Senior Fellow at the Center for Public Leadership at Harvard Kennedy School, a graduate and professional school. From 2013 to 2017, she was the Executive Director at the Center for Public Leadership at the Harvard Kennedy School and from 2010 to 2013, she was the Executive Director of Executive Education at Harvard Business School, a graduate and professional school. Prior to joining Harvard Business School, Ms. Bellinger was group vice president at British Petroleum, a global energy company, from 2000 to 2007, where she oversaw leadership development programs and established and led British Petroleum’s global diversity and inclusion transformation. Ms. Bellinger served as a director of Pattern Energy Group Inc., a power company, from 2013 until 2018 and Paris-based Sodexo S.A., from 2005 until 2018. She also serves as a director of Paris-based Sonepar, and as a trustee of uAspire. Ms. Bellinger’s nomination is supported by her extensive executive, business and leadership experience and service on several boards of directors.

Sarah E. Nash | Director Nominee | Age 65 |

Ms. Nash is the Chair of the Board and Chief Executive Officer of privately held Novagard Solutions, a manufacturer of silicone sealants, coatings, foam and thermal products, and has held this position since 2018. Ms. Nash spent nearly 30 years in investment banking at JPMorgan Chase & Co. (and predecessor companies), retiring as Vice Chairman, Global Investment Banking, in 2005. Ms. Nash currently serves on the board of Blackbaud, Inc., a software company providing technology solutions for the not-for-profit industry, and has done so since 2010, on the board of Knoll, Inc., a designer and manufacturer of lifestyle and workplace furnishings, textiles and fine leathers, and has done so since 2006, and on the board of privately held Irving Oil Company, and has done so since 2012. Ms. Nash previously served as a director of Merrimack Pharmaceuticals, Inc., a biopharmaceutical company, from 2006 until 2014. Ms. Nash is a trustee of the New York-Presbyterian Hospital, a member of the National Board of the Smithsonian Institution and Chairman of the International Advisory Board of the Montreal Museum of Fine Arts. Ms. Nash’s nomination is supported by her extensive experience in capital markets, strategic transactions, corporate governance and non-profit organizations.

Anne Sheehan | Director Nominee | Age 62 |

Ms. Sheehan is the Chair of the Securities and Exchange Commission’s Investor Advisory Committee. From 2008 until 2018, Ms. Sheehan served as the Director of Corporate Governance at The California State Teachers’ Retirement System (CalSTRS), the largest educator-only pension fund in the world and the second largest pension fund in the United States. She previously served as the Chief Deputy Director for Policy at the California Department of Finance from 2004 to 2008 and as Executive Director at the California Building Industry Foundation from 2000 to 2004. Ms. Sheehan is a founder of the Investor Stewardship Group and serves on the Advisory Board of the Weinberg Center for Corporate Governance at the University of Delaware. Ms. Sheehan’s nomination is supported by her extensive experience as a corporate governance professional and her senior management and leadership experience addressing complex legislative, regulatory and public finance issues.

Leslie H. Wexner | Director since 1963 | Age 81 |

Mr. Wexner has been Chief Executive Officer of the Company since he founded the Company in 1963, and Chairman of the Board for 43 years. Mr. Wexner is the husband of Abigail S. Wexner. Mr. Wexner’s nomination is supported by his effective leadership of the Company since its inception.

Directors Whose Terms Continue until the 2020 Annual Meeting

Donna A. James | Director since 2003 | Age |

In April 2006, Ms. James established Lardon & Associates LLC, a business and executive advisory services firm, where she is Managing Director. Ms. James served as the President of Nationwide Strategic Investments, a division of Nationwide Mutual Insurance Company, from 2003 through March 2006. Ms. James served as Executive Vice President and Chief Administrative Officer of Nationwide Mutual Insurance Company and Nationwide

5

Financial Services from 2000 until 2003. Ms. James is a director of Marathon Petroleum Corp., a transportation fuels refiner and Boston Scientific Corporation, a developer, manufacturer and marketer of medical devices. Ms. James served as a director of Marathon Petroleum Corp., a transportation fuels refiner, from 2011 to 2018. Ms. James also served as Chairman of Financial Settlement Services Agency, Inc. from 2005 through 2006, as director of CNO Financial Group, Inc., a holding company for a group of insurance companies, from 2007 to 2011, as director of Coca-Cola Enterprises Inc., a nonalcoholic beverages company, from 2005 to 2012 and as a director of Time Warner Cable Inc., a provider of video, data and voice services, from 2009 to 2016. She currently serves as the Chair of the Audit Committee of Marathon Petroleum Corp. Ms. James’s nomination was supported by her executive experience, financial expertise, service on several boards of directors and experience with respect to corporate diversity and related issues.

Mr. Miro has been a senior partner of the Honigman Miller Schwartz and Cohn LLP law firm since November 2004. He was a partner and Chairman of the law firm of Miro Weiner & Kramer from 1981 until November 2004. He is an Adjunct Professor of Law at The University of Michigan Law School, teaching courses in taxation and corporate governance. Mr. Miro was a director of M/I Homes, Inc., a national home building company, until December 2012, and was a director of Sotheby’s Holdings, Inc., an auctioneer of art, jewelry and collectibles, until May 2006. Mr. Miro’s nomination was supported by his legal expertise, particularly with respect to corporate governance and real estate matters.

Michael G. Morris | Director since 2012 | Age |

Mr. Morris served as the Chairman of the Board of American Electric Power Company, Inc., one of the largest electric utilities in the United States, from 2012 to April 2014. From January 2004 until November 2011, Mr. Morris served as the President, Chief Executive Officer and Chairman of American Electric Power Company, Inc. From 1997 until 2003, he served as the President, Chairman and Chief Executive Officer of Northeast Utilities, the largest electric utility in New England. From 2013 to 2017, Mr. Morris currently servesserved as a director of Spectra Energy Corp., one of North America’s leading natural gas infrastructure companies until its acquisition by Enbridge Inc., and from 2017 to 2018, Mr. Morris served as director of Spectra Energy Partners GP, LLC, the general partner of Spectra Energy Partners (DE) GP, LP, the general partner of Spectra Energy Partners, LP, a master limited partnership engaged in the transmission, storage and gathering of natural gas, and the transportation and storage of crude oil, until its acquisition by Enbridge Inc. Mr. Morris currently serves as a director of The Hartford Financial Services Group, Inc., an investment and insurance company, and as the Non-Executive Chairman of the board of directors of Alcoa Corporation, a producer of bauxite, alumina and aluminum. Mr. Morris is also a director of PLH Group, Inc. Mr. Morris served as a director of Alcoa Inc., a producer of aluminum, from 2008 to 2016, until Alcoa Inc.’s separation into two standalone, publicly-traded companies, Alcoa Corporation and Arconic Inc. Mr. Morris’s nomination was supported by his broad business experience and management expertise.

Robert H. Schottenstein | Director since 2017 | Age 66 |

Mr. Schottenstein has been the Chairman and Chief Executive Officer of M/I Homes, Inc., one of the nation’s largest homebuilders, since 2004. He has served on the board of Installed Building Products, Inc., a leading installer of insulation and complementary building products for residential new construction, since 2014. He also serves on the boards of The Ohio State University Wexner Medical Center, Columbus 2020, The Ohio State University Foundation and the Executive Committee of Harvard University’s Joint Center for Housing. Mr. Schottenstein’s nomination was supported by his management and business experience and involvement in various public policy issues.

Raymond Zimmerman | Director since 1984 | Age |

Mr. Zimmerman is the Chief Executive Officer of Service Merchandise LLC, a retail company. Mr. Zimmerman was Chairman of the Board and Chief Executive Officer of 99¢ Stuff, LLC from 1999 to 2003 and the Chairman of the Board and Chief Executive Officer of 99¢ Stuff, Inc. from 2003 to 2008. Mr. Zimmerman’s nomination was supported by his financial expertise and broad business experience, particularly in the retail sector.

Directors Whose Terms Continue until the 20182021 Annual Meeting

E. Gordon Gee | Director since 2012 | Age |

Dr. Gee is currently the President of West Virginia University, a large public research institution. Prior to his current service at West Virginia University, he led several other major universities, including The Ohio State University (2007—2013, 1990—1998), Vanderbilt University (2000—2007), Brown University (1998—2000), the University of Colorado (1985—1990), and West Virginia University (1981—1985). Dr. Gee also currently serves as a director of the National4-H Council. He previously served as a director of the Company from 1992 to 2008, as a director of Hasbro, Inc., a branded-play company, from 1999 until 2010, and as a director of Bob Evans Farms, Inc., an owner and operator of family restaurants, from 2009 until 2014. Dr. Gee’s nomination was supported by his extensive executive and management experience, as well as his legal expertise and knowledge of the Company gained through his prior service as a director.

6

Stephen D. Steinour | Director since 2014 | Age |

Mr. Steinour has been the Chairman, President & Chief Executive Officer of Huntington Bancshares Incorporated, a regional bank holding company, since 2009. From 2008 to 2009, Mr. Steinour was a Managing Partner in CrossHarbor Capital Partners, LLC, a recognized leading manager of alternative investments. Mr. Steinour was with Citizens Financial Group from 1992 to 2008, where he served in various executive roles, including President from 2005 to 2007 and Chief Executive Officer from 2007 to 2008. Mr. Steinour currently serves as a director of Exelon Corporation, a utility services holding company. He previously served as a trustee of Liberty Property Trust, a real estate investment trust, from 2010 to 2014. Mr. Steinour also serves on the board of the Federal Reserve Bank of Cleveland. Mr. Steinour’s nomination was supported by his executive experience, financial expertise and service on several boards of directors.

Allan R. Tessler | Director since 1987 | Age |

Mr. Tessler has been Chairman of the Board and Chief Executive Officer of International Financial Group, Inc., an international merchant banking firm, since 1987 and is the Chairman and Chief Executive Officer of Teton Financial Services, a financial services company. He previously served as Chairman of the Board of Epoch Holding Corporation, an investment management company, from 2004 to 2013, and as Chairman of the Board of

J Net Enterprises Inc., a technology holding company, from 2000 to 2004.2004, as Chairman of the Board of Imperva, Inc., a provider of cyber security solutions, where he served as a director from 2015 to 2019, and as a director of Steel Partners Holdings GP Inc., a general partner of a global diversified holding company, from 2010 to 2018. Mr. Tessler also served as Chairman of the Board of InterWorld Corporation from 2001 to 2004 and as Chairman of Checker Holdings Corp. IV from 1997 to 2009. Mr. Tessler currently serves as Chairman of the Board of Rocky Mountain Bank, a Wyoming bank. He has served as a director of TD Ameritrade Holding Corporation, a securities brokerage company, since November 2006, as a director of Steel Partners Holdings GP Inc., a general partner of a global diversified holding company, since 2010,and as a director of BioCardia, Inc., a clinical-stage regenerative medicine company, since 2012 and as a director of Imperva, Inc., a provider of cyber security solutions, since 2015.2012. Mr. Tessler currently serves onas the Audit Committee of Imperva, Inc. and as Chair of the Audit Committee of BioCardia, Inc. Mr. Tessler’s nomination was supported by his broad business experience and financial expertise, together with his involvement in various public policy issues.

Abigail S. Wexner | Director since 1997 | Age |

Mrs. Wexner is the chairman, CEO and CEOFounder of Whitebarn Associates, LLC a private investment company. She serves on the boards of Advanced Drainage Systems, Inc., a manufacturer of high performance thermoplastic corrugated pipe, The Ohio State University, Nationwide Children’s Hospital, the Columbus Downtown Development Corporation, the Columbus Partnership, Pelotonia, The Ohio State University Wexner Medical Center, The Wexner Foundation, The Columbus Jewish Federation and the United States Equestrian Team Foundation. She is founder and chair of the board for The Center for Family Safety and Healing, founding board member and vice chair of the board for KIPP Columbus and a past chair of the Governing Committee of the Columbus Foundation. Mrs. Wexner is the wife of Leslie H. Wexner. Mrs. Wexner’s nomination was supported by her executive and legal experience, as well as her expertise with respect to a wide range of diversity, philanthropic and public policy issues.

Former Directors Whose Terms Continue until

David T. Kollat and Dennis S. Hersch have determined not to stand for reelection. We thank them for their exceptional commitment and distinguished service to the 2019 Annual MeetingCompany.

Mr. Hersch is President of N.A. Property, Inc., through which he acts as a business advisor to Mr. and Mrs. Wexner, and has done so since February 2008. He also serves as a trustee of several trusts established by Mr. and Mrs. Wexner. He was a Managing Director of J.P. Morgan Securities Inc., an investment bank, from December 2005 through January 2008, where he served as the Global Chairman of its Mergers & Acquisitions Department. Mr. Hersch was a partner of Davis Polk & Wardwell LLP, a New York law firm, from 1978 until December 2005. Mr. Hersch served as a director of Clearwire Corporation, a telecommunications company, from 2008 until 2013, NBCUniversal Enterprise, Inc., a media related company, from 2013 until 2014, Sprout Foods, Inc., a producer of organic baby food, from 2009 until 2015 and has served as a director of PJT Partners Inc., a financial advisory firm, since 2015. Mr. Hersch’s nomination was supported by his legal and financial expertise, as well as his considerable experience with corporate governance matters, strategic issues and corporate transactions.

Dr. Kollat has been Chairman of 22, Inc., a management consulting firm, since 1987. He has served as director of Select Comfort Corporation, a designer, manufacturer and retailer of premium beds and bedding accessories, since 1994, and Wolverine World Wide, Inc., a global footwear, athletic apparel and accessories designer, manufacturer and retailer, since 1992. Dr. Kollat also served as director of Big Lots, Inc., a retailer, from 1990 to 2012. In addition to his broad business experience (including service on several boards of directors) and marketing expertise, Dr. Kollat’s nomination was supported by his particular experience in the retail, apparel and other related industries, both at the management and board levels.

Mr. Wexner has been Chief Executive Officer of the Company since he founded the Company in 1963, and Chairman of the Board for 41 years. Mr. Wexner is the husband of Abigail S. Wexner. Mr. Wexner’s nomination was supported by his effective leadership of the Company since its inception.

Director Independence

The Board has determined that each of the individuals nominated to serve on the Board, together with David T. Kollat and each of the members of the Board who will continue to serve after the 20172019 annual meeting of stockholders (except for Dennis S. Hersch, Abigail S. Wexner and Leslie H. Wexner), has no material relationship with the Company other than in his or her capacity as a director of the Company and that each is “independent” in accordance with applicable NYSE standards. If all director nominees are elected to serve as our directors, independent directors will constitute more thantwo-thirdsover 80% of our Board.

In making these determinations, the Board took into account all factors and circumstances that it considered relevant, including, where applicable, the existence of any employment relationship between the director (or nominee) or a member of the director’s (or nominee’s) immediate family and the Company; whether within the past

7

three years the director (or nominee) has served as an executive officer of the Company; whether the director (or nominee) or a member of the director’s (or nominee’s) immediate family has received, during any twelve-month period within the last three years, direct compensation from the Company in excess of $120,000; whether the director (or nominee) or a member of the director’s (or nominee’s) immediate family has been, within the last three years, a partner or an employee of the Company’s internal or external auditors; and whether the director (or nominee) or a member of the director’s (or nominee’s) immediate family is employed by an entity that is engaged in business dealings with the Company. The Board has not adopted categorical standards with respect to director independence. The Board believes that it is more appropriate to make independence determinations on acase-by-case basis in light of all relevant factors.

Board Leadership Structure

Mr. Leslie H. Wexner serves as Chairman of the Board and Chief Executive Officer (“CEO”) of the Company. Mr. Wexner is the founder of the Company and has served as its Chairman and/or Chief Executive Officer for over fifty years.Company. Mr. Wexner (through his personal holdings and associated trusts)beneficial holdings) is also the Company’s largest stockholder. The Board believes that Mr. Wexner’s experience and expertise in the Company’s business and operations is unrivaled and that he is uniquely qualified to lead the Company. Accordingly, the Company believes that Mr. Wexner’s service as both Chairman of the Board and Chief Executive Officer is a significant benefit to the Company and provides more effective leadership than could be achieved in another leadership structure.

Allan R. Tessler currently serves as the lead independent director. In July 2012, the Board determined that the lead independent director should be appointed solely by the independent directors, as they deem appropriate, and Mr. Tessler was subsequently reappointed as the lead independent director by them. As lead independent director, Mr. Tessler has the authority to call meetings of the independent directors, at which he serves as the chairman. Mr. Tessler also approves information sent to the Board, including the agenda for Board meetings, and is responsible for approving meeting schedules in order to assure that there is sufficient time for discussion of all agenda items.

The Company believes that the lead independent director structure, including Mr. Tessler’s service as lead independent director, offers independent oversight of the Company’s management to complement the leadership that Mr. Wexner provides to the Board as its Chairman.

Risk Oversight; Certain Compensation Matters

The Board, directly and through the Audit Committee and other committees of the Board, takes an active role in the oversight of the Company’s policies with respect to the assessment and management of enterprise risk. Among other things, the Board has policies in place for identifying the senior executive responsible for key risks as well as the Board committees with oversight responsibility for particular key risks. In a number of cases, oversight is conducted by the full Board.

Among other things, the Company, including the Compensation Committee of the Board, has evaluated the Company’s compensation structure from the perspective of enterprise risk. The Company, including the Compensation Committee, believes that the Company’s compensation structures are appropriate and do not incentivize inappropriate taking of business risks.

Cybersecurity Risk

The Board and the Audit Committee take an active role in the oversight of the Company’s cybersecurity and data security policies. Among other things, the Board periodically reviews with members of management of the Company issues relating to information security, fraud, data security and cybersecurity risk and developments as well as the steps management has taken to monitor and control such exposures.

Review of Strategic Plans and Capital Structure

The Board regularly reviews the Company’s strategic plans and capital structure with a view toward long-term value creation.creation, including environmental, social and governance considerations. The Board also conducts a strategic planning retreat at least annually with senior management.

8

Social Responsibility

The Company is a values-based company and we strive to operate our business according to high standards of social responsibility. The Board reviews issues of social responsibility, including diversity and inclusion, environmental, philanthropic and governance matters, and the Company’s policies, practices and progress with respect to such issues. Key areas of focus and highlights include:

Human Capital Management

The Board recognizes that attracting, developing and retaining the best people is crucial to all aspects of the Company’s activities and long-term success and has oversight of the development and implementation of our human capital management programs, including diversity and inclusion practices and initiatives, recruiting, retention and career development and progression. Among other things, the Board reviews with members of management of the Company issues relating to human capital management such as employee engagement, workforce planning and demographics, diversity and inclusion strategies and our corporate culture.

Succession Planning

The Board and its Nominating & Governance Committee have developed policies and principles governing succession planning with respect to the CEO and senior management.

Information Concerning Board Meeting Attendance

Our Board held 810 meetings in fiscal year 2016.2018. During fiscal year 2016,2018, all of the directors attended 75% or more of the total number of meetings of the Board and of the committees of the Board on which they served (which were held during the period in which they served).

Committees of the Board

Audit Committee

The Audit Committee of the Board is instrumental in the Board’s fulfillment of its oversight responsibilities relating to (i) the integrity of the Company’s financial statements, (ii) the Company’s compliance with legal and regulatory requirements, (iii) the qualifications, independence and performance of the Company’s independent auditors and (iv) the performance of the Company’s internal audit function. The current members of the Audit Committee are Ms. James (Chair), Dr. Kollat and Messrs. Schottenstein, Tessler and Zimmerman. The Board has determined that each of the Audit Committee members meets the independence, expertise and experience standards established by the NYSE and the Securities and Exchange Commission (the “Commission”) for service on the Audit Committee of the Board and for designation as an “audit committee financial expert” within the meaning of the regulations promulgated by the Commission.

9

The Report of the Audit Committee can be found on page 55 of this proxy statement. The Audit Committee held 1312 meetings in fiscal year 2016.2018.

Compensation Committee

The Compensation Committee of the Board (i) oversees the Company’s compensation and benefits philosophy and policies generally, (ii) evaluates the CEO’s performance and oversees and sets compensation for the CEO, (iii) oversees the evaluation process and compensation structure for other members of the Company’s senior management and (iv) fulfills the other responsibilities set forth in its charter. The current members of the

Compensation Committee are Dr. Kollat (Chair), Dr. Gee and Messrs. Miro andMr. Morris. The Board has determined that each of the current Compensation Committee members is “independent” in accordance with applicable NYSE standards.

The Report of the Compensation Committee can be found on page 50pages 48 to 49 of this proxy statement. The Compensation Committee held 912 meetings in fiscal year 2016.2018.

Nominating & Governance Committee

The Nominating & Governance Committee actively engages in the ongoing review of the composition of the Board and opportunities for Board refreshment. Based on its review, the Nominating & Governance Committee identifies and recommends to the Board candidates who are qualified to serve on the Board and its committees. The Nominating & Governance Committee also considers and reviews the qualifications of any individual nominated for election to the Board by stockholders. It is responsible for proposing a slate of candidates for election as directors at each annual meeting of stockholders. In the pastIf all of our nominees are elected this year, we would have added five years, three new directors have been appointed to the Boardsince 2014 who bring a diversity of skills, attributes and perspectives to the Board. In addition to periodicongoing Board refreshment, we believe that a variety of director tenures is beneficial to ensure Board quality and continuity of experience, as reflected in the current composition of our Board.

The Nominating & Governance Committee develops and recommends to the Board criteria and procedures for the selection and evaluation of new individuals to serve as directors and committee members. In assessing director nominees, the Nominating & Governance Committee takes into account the qualifications of existing directors for continuing service orre-nomination, which may be affected by, among other things, the quality of their contributions, their attendance records, changes in their primary employment or other business affiliations, the number of boards of publicly held companies on which they serve or other competing demands on their time and attention. While the Board has not established any specific minimum qualifications for director nominees, as indicated in the Company’s corporate governance principles, the directors and any potential nominees should possess the integrity, judgment, skills, experience and other characteristics that are deemed necessary or desirable for the effective performance of the Board’s oversight function. Certain of the skills, qualifications and particular areas of expertise considered with respect to the members of the Board at the time each Director was nominated are summarized in the director biographies found on pages 5 through 87 of this proxy statement. Although the Nominating & Governance Committee does not use formal quantitative or similar criteria with regard to diversity in its selection process, the Company’s corporate governance principles provide that the Board will be composed of members of diverse backgrounds and, accordingly, the Committee considers the diversity of experience, background and expertise of the current directors and areas where new directors might add additional perspectives, as factors in the selection of Board nominees.

The Nominating & Governance Committee does not have a formal policy on the consideration of director candidates recommended by stockholders. The Board believes that it is more appropriate to provide the Nominating & Governance Committee flexibility in evaluating stockholder recommendations. In the event that a director nominee is recommended by a stockholder, the Nominating & Governance Committee will give due consideration to the director nominee and will use the same criteria used for evaluating Board director nominees, in addition to considering the information relating to the director nominee provided by the stockholder.

To date,The Company engaged a search firm to assist the Company has not engaged third parties to identify or evaluate or assistNominating & Governance Committee in identifying and evaluating potential director nominees, although the Company reserves the right in the future to retain a third-party search firm, if appropriate.directors.

The Nominating & Governance Committee also develops and recommends to the Board, and regularly reviews, a set of corporate governance principles for the Company to ensure they reflect evolving best practices, monitors compliance with those principles and stays abreast of developments in the area of corporate governance. For example, a proxy access bylaw was adopted in November 2016, permitting up to 20

stockholders owning 3% or more of the outstanding shares of Common Stock continuously for at least three years to nominate the greater of two directors

10

or up to 20% of the Board and include those nominees in our proxy materials. The Nominating & Governance Committee also reviews and periodically makes recommendations to the Board regarding the structure, practices, policies and activities of the Board and its committees. Each Board committee’s charter is reviewed at least annually. To ensure that the Board, Board committees and individual directors remain effective, the Nominating & Governance Committee oversees a robust annual evaluation of the Board, each Board committee and each individual director and recommends ways to improve performance. At least annually, each of the Audit Committee, the Compensation Committee and the Nominating & Governance Committee evaluates its own performance and reports to the Board on such evaluation. The full Board also engages in self-evaluation at least annually. The current members of the Nominating & Governance Committee are Mr. Tessler (Chair), Ms. James and Dr. Kollat and Mr. Miro.Kollat. The Board has determined that each of the current Nominating & Governance Committee members is “independent” in accordance with applicable NYSE standards.

The Nominating & Governance Committee held 43 meetings in fiscal year 2016.2018.

Executive Committee

The Executive Committee of the Board may exercise, to the fullest extent permitted by law, all of the powers and authority granted to the Board. Among other things, the Executive Committee may declare dividends, authorize the issuance of stock and authorize the seal of the Company to be affixed to papers that require it. The current members of the Executive Committee are Messrs. Wexner (Chair) and Tessler.

Finance Committee

The Finance Committee of the Board periodically reviews the Company’s financial position and financial arrangements with banks and other financial institutions. The Finance Committee also makes recommendations on financial matters that it believes are necessary, advisable or appropriate. The current members of the Finance Committee are Mr. Tessler (Chair), Mr. Hersch, Dr. Kollat, Mrs. Wexner and Mr. Zimmerman.

Inclusion Committee

The Inclusion Committee of the Board is instrumental in the Board’s fulfillment of its oversight responsibilities relating to, among other things, (i) the Company’s commitment to diversity and inclusion and (ii) the performance of the Company’s Office of Inclusion. The current members of the Inclusion Committee are Mrs. Wexner (Chair), Ms. Bellinger, Dr. Gee and Ms. James.

Retiring Committee Members

Effective as of the annual meeting, Mr. Hersch and Dr. Kollat will conclude service on the Board and the respective Committees on which they serve.

Meetings of the Company’sNon-Management Directors

Thenon-management directors of the Board meet in executive session in connection with each regularly scheduled Board meeting. Mr. Tessler serves as the chair of those meetings, which neither Mr. Wexner nor Mrs. Wexner attends.

Communications with Stockholders

The Board believes that it is important to understand stockholder perspectives on the Company and foster long-term relationships with stockholders and, to that end, we have a policy of robust engagement with stockholders, with continuing outreach to and dialogue with all of our major investors on a range of issues, including corporate governance matters.matters and environmental and social goals and initiatives. Such engagements with investors have been highly constructive. For example, based on stockholder feedback, we made a number of changes to our compensation program in the past few years, as discussed in more detail under “Compensation-Related Matters—Compensation Discussion and Analysis.” The Board also provides a process for interested parties to send communications to the full Board, the

non-management members of the Board, the lead independent director and the members of the Audit Committee. Any director may be contacted by writing to him or her c/o L Brands, Inc., Three Limited Parkway, Columbus, Ohio 43230 or emailing atboardofdirectors@lb.com. Any stockholder wishing to contact Audit Committee members may send an email toauditcommittee@lb.com. Communications that are not related to a director’s duties and responsibilities as a Board member, anon-management director or an Audit Committee member may be excluded by the Office of the General Counsel, including, without limitation, solicitations and

11

advertisements; junk mail; product-related communications; job referral materials such as resumes; surveys; and any other material that is determined to be illegal or otherwise inappropriate. The directors to whom such information is addressed are informed that the information has been removed and that it will be made available to such directors upon request.

Attendance at Annual Meetings

The Company does not have a formal policy regarding attendance by members of the Board at the Company’s annual meeting of stockholders. However, it encourages directors to attend and historically nearly all have done so. All of the then-current Board members attended the 20162018 annual meeting.meeting, except for Mr. Morris. Each director is expected to dedicate sufficient time, energy and attention to ensure the diligent performance of his or her duties, including by attending meetings of the Board and the committees of which he or she is a member.

Code of Conduct, Related Person Transaction Policy and Associated Matters

The Company has a code of conduct that is applicable to all employees of the Company, including the CEO and Chief Financial Officer, and to members of the Board. Any amendments to the code or any waivers from any provisions of the code granted to executive officers or directors will be promptly disclosed to stockholders through posting on the Company’s website atwww.lb.com.

Under the Company’s Related Person Transaction Policy (the “Policy”), subject to certain exceptions, directors and executive officers of the Company are required to notify the Company of the existence or potential existence of any financial or commercial transaction, agreement or relationship involving the Company in which a director or executive officer or his or her immediate family members has a direct or indirect material interest. Each such transaction must be approved by the Board or a committee consisting solely of independent directors after consideration of all material facts and circumstances.

The Company is engaged in several projects designed to increase our speed and agility in producing products that satisfy our customers. In the case of our beauty, personal care and home fragrance businesses, the development of supplier facilities in close proximity to our headquarters and distribution facilities in central Ohio has been an integral part of capturing the many business benefits of speed and agility. The New Albany Company, a business beneficially owned by Mr. and Mrs. Wexner, is in the business of developing real estate, including industrial parks, and has sold land (and may in the future sell land) to certain vendors or third party developers in connection with the continuing development of an industrial park focused on the foregoing business categories in New Albany, Ohio. The Audit Committee monitors such vendor and third party transactions on an ongoing basis to assure that they are in the best interests of the Company and its stockholders generally.

Copies of the Company’s Code of Conduct, Corporate Governance Principles, Policy and Committee Charters

The Company’s code of conduct, corporate governance principles and Policy, as well as the charters of the Audit Committee, Compensation Committee and Nominating & Governance Committee of the Board, are available on the Company’s website atwww.lb.com. Stockholders may also request a copy of any such document from: L Brands, Inc., Attention: Investor Relations, Three Limited Parkway, Columbus, Ohio 43230.

12

PROPOSAL 2: RATIFICATION OF THE APPOINTMENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Audit Committee has appointed Ernst & Young LLP to serve as the Company’s independent registered public accountants for the fiscal year ending February 3, 2018.1, 2020. Ernst & Young LLP has been retained as the Company’s independent registered public accountants continuously since 2003.

The Audit Committee is responsible for the appointment, compensation, retention and oversight of the Company’s independent registered public accountants. The Audit Committee is responsible for approving the fees associated with the Company’s retention of Ernst & Young LLP. In accordance with Commission rules, Ernst & Young LLP’s lead engagement partner rotates every five years. The Audit Committee is directly involved in the selection of Ernst & Young LLP’s lead engagement partner. In addition, the Audit Committee evaluates Ernst & Young LLP’s qualifications, performance and independence and presents its conclusions on these matters to the Board on at least an annual basis, and annually considers whether to continue its engagement of Ernst & Young LLP.

The members of the Audit Committee and the Board believe that the continued retention of Ernst & Young LLP to serve as the Company’s independent registered public accountants is in the best interests of the Company and its stockholders. We are asking you to ratify Ernst & Young LLP’s appointment, although your ratification is not required. A representative of Ernst & Young LLP will be present at the meeting, will have the opportunity to make a statement and will be available to respond to appropriate questions.

Additional information concerning the Company’s engagement of Ernst & Young LLP is included on page 56.56.

The Board recommends a vote FOR the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accountants.

13

PROPOSAL 3: ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER

COMPENSATION

COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act requires us to provide an advisory stockholder vote to approve the compensation of the Company’s named executive officers (“NEOs”), as such compensation is disclosed pursuant to the disclosure rules of the Commission. After the Company’s 20112017 annual meeting, the Board determined to hold this advisory“say-on-pay” “say-on-pay” vote every year. Accordingly, the Company is providing its stockholders with the opportunity to cast an advisory vote on the fiscal 20162018 compensation of our NEOs as disclosed in this proxy statement, including the Compensation Discussion and Analysis (the “CD&A”), the compensation tables and other narrative executive compensation disclosures.

Stockholders are being asked to vote on the following resolution:

“RESOLVED, that the stockholders approve the compensation of the Company’s executive officers named in the 20162018 Summary Compensation Table, as disclosed pursuant to Item 402 of RegulationS-K (which disclosure includes the Compensation Discussion and Analysis, the compensation tables and other narrative executive compensation disclosures).”

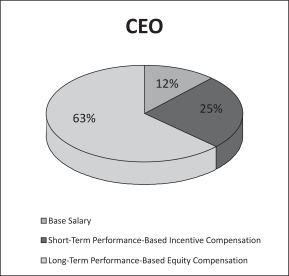

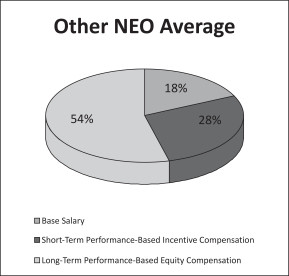

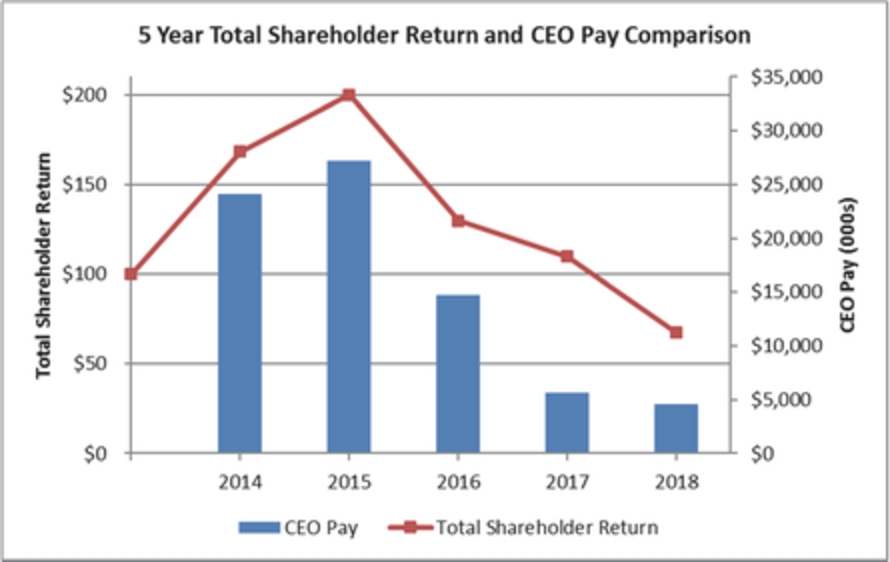

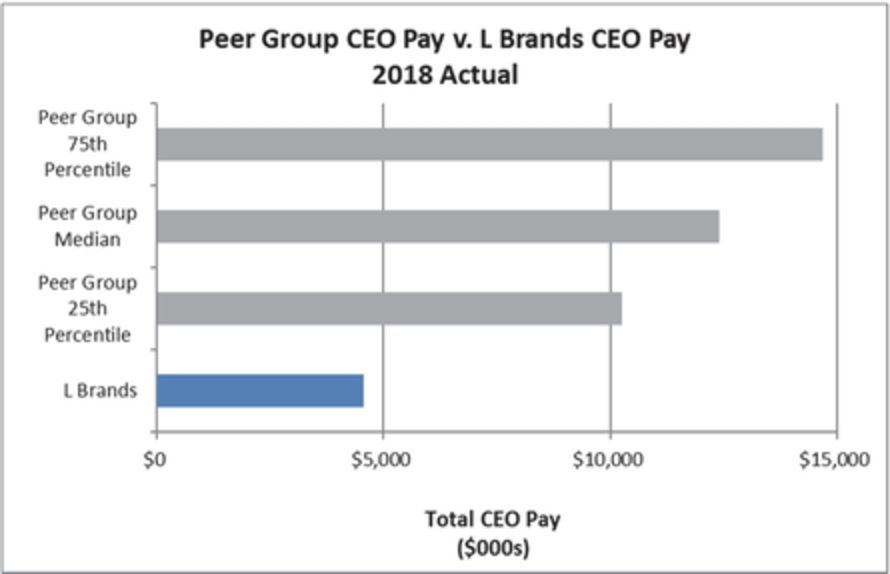

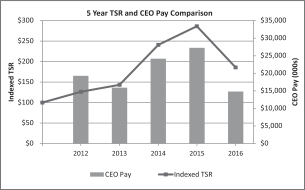

OurWe are committed to aligning our executive compensation program iswith our Company’s performance. Over the last several years, the Company implemented a series of initiatives designed to align NEO compensation with the performancebetter position several of the company. Following five straight years of record-setting sales and earnings, financial performanceour businesses for the future. The short-term effects of some of these initiatives have not produced the results that are expected. In response, the Compensation Committee reduced our CEO’s target and actual compensation each year did not meet our high expectations and this is reflectedsince 2016. These actions by the Compensation Committee (summarized below), resulted in the significant decrease in 2016 compensation for our NEOs. CEO compensation that decreased 46% and83% from fiscal 2015 to fiscal 2018 while total shareholder return decreased 66% during this same period.

2017 Compensation Actions

2018 Compensation Actions

The Compensation Committee took the following actions:

No changes were made toadjusted Mr. Wexner’s target compensation for fiscal 2018 to reduce the amount of fixed compensation and put greater emphasis on performance-based compensation:

Awarded Mr. Wexner performance-based stock awards withtarget from $4.4 million to $1.5 million, a target valuereduction of $9.4 million (45% lower than fiscal 2015) based on financial and strategic performance during fiscal 2016, including growth66% or $2.9 million.

As NEO base salaries and short termlong-term performance-based incentive compensation targetsfrom 44% to 72% of total direct compensation.

14

increased2019 Compensation Actions

The Compensation Committee further adjusted Mr. Wexner’s target compensation for fiscal 2019 by reducing the base salary for eachamount of the NEOs other than Mr. Wexner based on our growthfixed compensation and accomplishments in the last several fiscal years, including record-setting sales and earnings performance in 2013, 2014 and 2015; and

increased short termlong-term performance-based incentive compensation targets for eachat target:

Awarded

Set short term incentive compensation operating income goalstarget from $6.5 million to $5.1 million.

Paid short-term incentive compensation below target for Messrs. Wexner, McGuigan, Burgdoerfer and Waters reflecting performance that did not meet our challenging goals.

Continued to deliver long term equity compensation that is 100% performance-based in a mix of stock options and RSUs which must be earned based on achievement of a cumulative, long-term, relative performance measure.

Beginning with performance-based RSUs awarded in March 2017, eliminated the provision for performance-based RSUs in which awards not earned in one period may be earned in subsequent periods if the cumulative performance metric is achieved.

The Company’s change in stockholder return, including reinvested dividends, is aligned with changes in total CEO compensation (as disclosed in further detail in the CD&A).

Although the advisory stockholder vote on executive compensation isnon-binding, the Compensation Committee has considered and will continue to consider the outcome of the vote and feedback received from stockholders when making compensation decisions for NEOs. We have a policy of robust engagement with stockholders, including continuing outreach to and dialogue with allIn 2018, 98.5% voted in favor of our major institutional stockholders. Based on feedback from such engagement, as noted above, we eliminated the provision for performance-based RSUs in which awards not earned in one period may be earned in subsequent periods if the cumulative performance metric is achieved. We continued the following compensation practices in accordance with our corporate governance principles and/or in response to stockholder and advisory group feedback, including:

No taxgross-ups for NEOs upon a change in control.

“No hedging” policy governing stock trading.

Policy that discourages pledging of Company stock and requires advance approval of our General Counsel.

No future issuances of “single trigger” equity awards.

Clawback policy.

Stock ownership guidelines set at five times base salary for our CEO and three times base salary for other NEOs. Members of our Board must maintain ownership of at least the number of shares of Common Stock received as Board compensation over the previous four years.

These changes, along with our historical performance record, were important factors in achieving 89% stockholder support for our 2016 advisory vote on executive compensation. Given this strong level of support, the Compensation Committee has concluded that a large majority of our stockholders support our existing compensation program.

Please refer to the CD&A for a detailed discussion of the Company’s executive compensation principles and practices and the fiscal 20162018 compensation of our NEOs.

Our performance in 2016 is reflected in theMr. Wexner’s total compensation for fiscal 2018 was $4.6 million, which is well below the median of our NEOs, demonstrating our commitment to deliveringpeers. In addition, 2019 target pay for performance. CEO compensation decreased 46% and compensation foris 39% below the other NEOs decreased on average approximately 21%.median. In summary, we seethere is alignment between our performance, our stockholders’ interests and our CEO’s pay.

The Board recommends a vote FOR this proposal.

15

PROPOSAL 4: ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES

ON NAMED EXECUTIVE OFFICER COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act requires us to provide an advisory stockholder vote with respect to how often to present the advisory stockholder vote to approve the compensation of the Company’s NEOs (the“say-on-pay vote”), i.e., how often to present a proposal similar to Proposal 3: Advisory Vote to Approve Named Executive Officer Compensation. We must solicit your advisory vote on whether to have thesay-on-pay vote every 1, 2 or 3 years.

Accordingly, the Company is providing its stockholders with the opportunity to cast an advisory vote as to the appropriate frequency for thesay-on-pay vote. Stockholders may vote as to whether thesay-on-pay vote should occur every 1, 2 or 3 years, or may abstain from voting on the matter.

The Company values the opinion of its stockholders and believes that an annualsay-on-pay vote will best reinforce the Company’s desire to communicate with its stockholders. An annualsay-on-pay vote will allow the Company’s stockholders to regularly express a view on the Company’s compensation policies and practices.

Although, as an advisory vote, this proposal is not binding upon the Company or the Board, the Compensation Committee, which is comprised solely of independent directors and is responsible for making decisions regarding the amount and form of compensation paid to the Company’s executive officers, and the Nominating & Governance Committee, which is comprised solely of independent directors and is responsible for periodically reviewing the Company’s corporate governance principles, will each carefully consider the stockholder vote on this matter, along with all other expressions of stockholder views received on this matter.

The Board Recommends a Vote of “1 Year” for the Frequency of Future AdvisorySay-On-Pay Votes.

PROPOSAL 5: STOCKHOLDER PROPOSAL TO CHANGE CERTAINREMOVE SUPERMAJORITY VOTING REQUIREMENTS

John Chevedden, 2215 Nelson Ave., No. 205 Redondo Beach, CA 90278, owner of 90 shares of Common Stock, has notified the Company that he intends to submit the following proposal at this year’s meeting:

Proposal 5—4—Simple Majority Vote

RESOLVED, Shareholders request that our board take the stepseach step necessary so that each voting requirement in our charter and bylaws (that is explicit or implicit due to default to state law) that calls for a greater than simple majority vote be eliminated, and replaced by a requirement for a majority of the votes cast for and against applicable proposals, or a simple majority in compliance with applicable laws. If necessary this means the closest standard to a majority of the votes cast for and against such proposals consistent with applicable laws. It is essential that our board takeThis proposal includes taking the steps necessary to adopt this proposal.

We gave 56% voting supportadjourn the annual meeting to this same shareholder proposal at our 2015solicit the votes necessary for approval if the votes for approval are lacking during the annual meeting. However

Adjourn is mentioned 17 times in our management failed to take the steps necessary to adopt this proposal at our 2016 annual meeting. Plus our 2016 annual meeting proxy failed to give any management analysis of any special effort that might be needed to adopt the management version of this proposal or specify any special effort that management would take to adopt their proposal on this topic.

Shareowners are willing to pay a premium for shares of companies that have excellent corporate governance. Supermajority voting requirements have been found to be one of 6 entrenching mechanisms that are negatively related to company performance according to “What Matters in Corporate Governance” by Lucien Bebchuk, Alma Cohen and Allen Ferrell of the Harvard Law School. Supermajority requirements are used to block initiatives supported by most shareowners but opposed by a status quo management.

bylaws. This proposal topic won from 74% to 88% support at Weyerhaeuser, Alcoa, Waste Management, Goldman Sachs, FirstEnergy, McGraw-Hill and Macy’s. The proponents of these proposals included Ray T. Chevedden and William Steiner.

The votes would have been higher than 74% to 88% if all shareholders had equal access to independent proxy voting advice. Currently a 1%-minority can frustrate the will of our 74%-shareholder majority. In other wordsmajority on certain issues in an election in which 75% of shares cast ballots.

Adoption of this proposal would facilitate the adoption of annual election of each director. It is ridiculous to for an L Brands director beyond age 80 to run for a 1%-minority could have the power to prevent shareholders from improving3-year term and we had 4 such directors. Plus our charter and bylaws.

Thus we are stuck with3-year terms for directors which makes our directors significantly untouchable to shareholder frustration. Our stock fell from $100 to $65is in the year leading upcellar. In 5-years of a robust market our stock dropped from $61 to the submission of this proposal. Yet most of our directors do not have to worry about reelection at our 2017 annual meeting. This is like an employee with falling performance getting a job review once in3-years.$37.

Please vote to enhance shareholder value:yes:

Simple Majority Vote—Proposal 54

Our Response—Statement in Opposition toRegarding Stockholder Proposal to Change CertainRemove Supermajority Voting Requirements

The Board has carefully considered the above proposal and believes that it is not in the best interests of our stockholders. Consequently,After careful consideration, the Board recommends a vote AGAINST theFOR this stockholder proposal.

The Board has evaluated the Company’s voting requirements on numerous occasions to ensure that they continue to be in the best interests Regardless of the Company and its stockholders. Inwhether this regard,proposal is approved by stockholders, the Board has consistently determined, and continueswill take the necessary steps to believe after careful reconsideration of this issue, thatsubmit its own proposal at the retention of a supermajority vote standard for certain extraordinary matters is the best way2020 annual meeting to ensure that the interests of all stockholders are fully protected.

Our Supermajority Vote Requirements Apply Only to a Small Number of Fundamental Matters. Under the Company’s existing governance documents, a simple majority vote requirement already applies to most matters submitted for stockholder approval. Ouramend our certificate of incorporation only requires the affirmative vote of not less than 75% of the outstanding shares entitled to vote for a small number of fundamental matters of corporate structure and governance, which are as follows: (i) approval of certain business combinations with an individual, entity or group that collectively owns 20% or more of the Company’s voting securities; (ii) approval of certain fundamental transactions, including mergers or a sale of substantially all of the Company’s assets, with any corporation that, together with its affiliates, owns five percent or more of the Company’s voting securities; (iii) dissolution of the Company; (iv) removal of a director for cause; (v) an alteration, amendment or repeal of the Company’s bylaws or any amendment to the Company’s certificate of incorporation that contravenes any existing bylaw of the Company; and (vi) an amendment to certain provisions in the Company’s certificate of incorporation.

Our Supermajority Vote Requirements Serve Important Corporate Governance Objectives. Our Board believes that the requirement of a supermajority vote for a limited number of fundamental matters serves important corporate governance objectives. These include:

Ensuring Broad Stockholder Consensus for Key Actions. The Board strongly believes that extraordinary transactions and fundamental changes to corporate governance should have the support of a broad consensus of the Company’s stockholders rather than just a simple majority. The Board also believes that the supermajority vote requirements protect stockholders, particularly minority stockholders, from the potentially self-interested actions of short-term investors. Without these provisions, it would be possible for a group of short-term stockholders to approve an extraordinary transaction that is not in the best interests of the Company and opposed by nearly half of the Company’s stockholders. Targeted supermajority vote requirements, limited to a small number of critical matters, preserve and maximize long-term value for all stockholders.

Ensuring that Key Actions Reflect Stockholder Interests. Our Board is subject to fiduciary duties under the law to act in a manner that it believes to be in the best interests of the Company and its stockholders. Stockholders, on the other hand, do not have the same fiduciary duties. As a result, a group of stockholders—who may be acting in their own short-term or other interests not shared by stockholders generally—may vote in a manner that is detrimental to large numbers of stockholders. Accordingly, ourremove supermajority voting standards safeguard the long-term interests of the Company and its stockholders.requirements.

Providing Protection Against Certain Takeovers. Our supermajority voting provisions further protect the Company’s stockholders by encouraging persons or firms making unsolicited takeover proposals to negotiate directly with the Board, which provides the Board with increased leverage to maximize value for all stockholders. The Company believes that its independent Board is in the best position to evaluate proposed offers, consider alternatives and protect stockholders against potentially coercive or abusive tactics during a takeover process and, as appropriate, negotiate the best possible return for all stockholders. Elimination of these supermajority vote provisions would make it more difficult for the Company’s independent, stockholder-elected Board to preserve and maximize value for all stockholders in the event of an unsolicited takeover bid.

Corporate Governance Practices. The Board regularly evaluates the Company’s corporate governance practices and processes with a view toward ensuring that they continue to serve the best interests of the Company and its stockholders. For example, the Board adopted a proxy access bylaw in November 2016. The Board is also intensely focused on the relationship between governance and performance and on creating the proper governance structure in light of the particular circumstances of the Company. In addition, we have a policy of robust engagement with stockholders, with continuing outreach to and dialogue with all of our major investors on a range of issues, including corporate governance matters. The Board believes that the Company’s current corporate governance principles and practices—of which the supermajority vote requirements are one part—are optimal for the Company and its stockholders and serve, among other things, to maximize long-term stockholder

value, align the interests of the Board and management with those of our stockholders and promote high ethical conduct among our directors and employees.

Board Recommendation

After careful consideration of this proposal, the Board has determined that retention of the supermajority voting requirements remains in the best interests of the Company and its stockholders. The Board believes that the substantial benefits of the Company’s supermajority voting requirements do not come at the expense of prudent corporate governance. To the contrary, the voting requirements serve to protect the interests of all stockholders.

The Board recommends a vote AGAINSTFOR the Stockholder Proposal to Change CertainRemove Supermajority Voting Requirements.

16

Compensation Discussion and Analysis

Executive Summary

We are committed to aligning our executive compensation with our Company’s performance. Over the last several years, the Company implemented a series of initiatives designed to better position several of our businesses for the future. The short-term effects of some of these initiatives have not produced the results that are expected. In response, the Compensation Committee reduced our CEO’s target and actual compensation each year since 2016. These actions by the Compensation Committee (summarized below), resulted in CEO compensation that decreased 83% from fiscal 2015 to fiscal 2018 while total shareholder return decreased 66% during this same period. | |

The Board reviews the Company’s short- and long-term strategy with our CEO and management team regularly. As we have done in the past, we will continue to calibrate our CEO’s compensation to the results of the business, and to the returns of our stakeholders. | |

2017 Compensation Actions | |

• | Did not grant a Fall 2017 long-term performance-based equity incentive award. As a result, CEO long-term performance-based equity awards for fiscal 2017 were 70% ($3.5 million) below target. |

• | Exercised negative discretion to eliminate the Fall season short-term incentive payout, resulting in a total 2017 payout that was 75% ($3.3 million) below target. |

• | As a result of these actions, CEO compensation was 60% ($6.8 million) below the reduced target for fiscal 2017. |

• | CEO total compensation decreased by 61% ($9.1 million) from fiscal 2016 to fiscal 2017, while total shareholder return decreased by 15% during the same period. |

2018 Compensation Actions | |